US Federal Reserve: Politics, Law & Business

Contents:

They tend to share many of the relatively conservative political and economic views of the business and professional groups from which they are drawn. Because the President can not fire them from their positions before their fourteen-year terms expire, members of the Board of Governors normally feel relatively free to ignore or oppose the President's preferences when they make U.

Moreover, even though some members of the Board of Governors perhaps feel an ideological kinship or sense of political loyalty that might predispose them to support the policy views of the President who appointed them, the terms of the Governors are staggered, so that only one Governor's term expires every two years, making it unlikely that any President would be able to dominate the Board with a majority of his own appointees until near the end of his own second four- year term in office. However, every four years, the President does at least get the opportunity to designate which one of the seven Governors will serve for the next four years as Chairman of the Board of Governors and exercize "moral leadership" as first among equals in the Governors' collective deliberations on monetary policy.

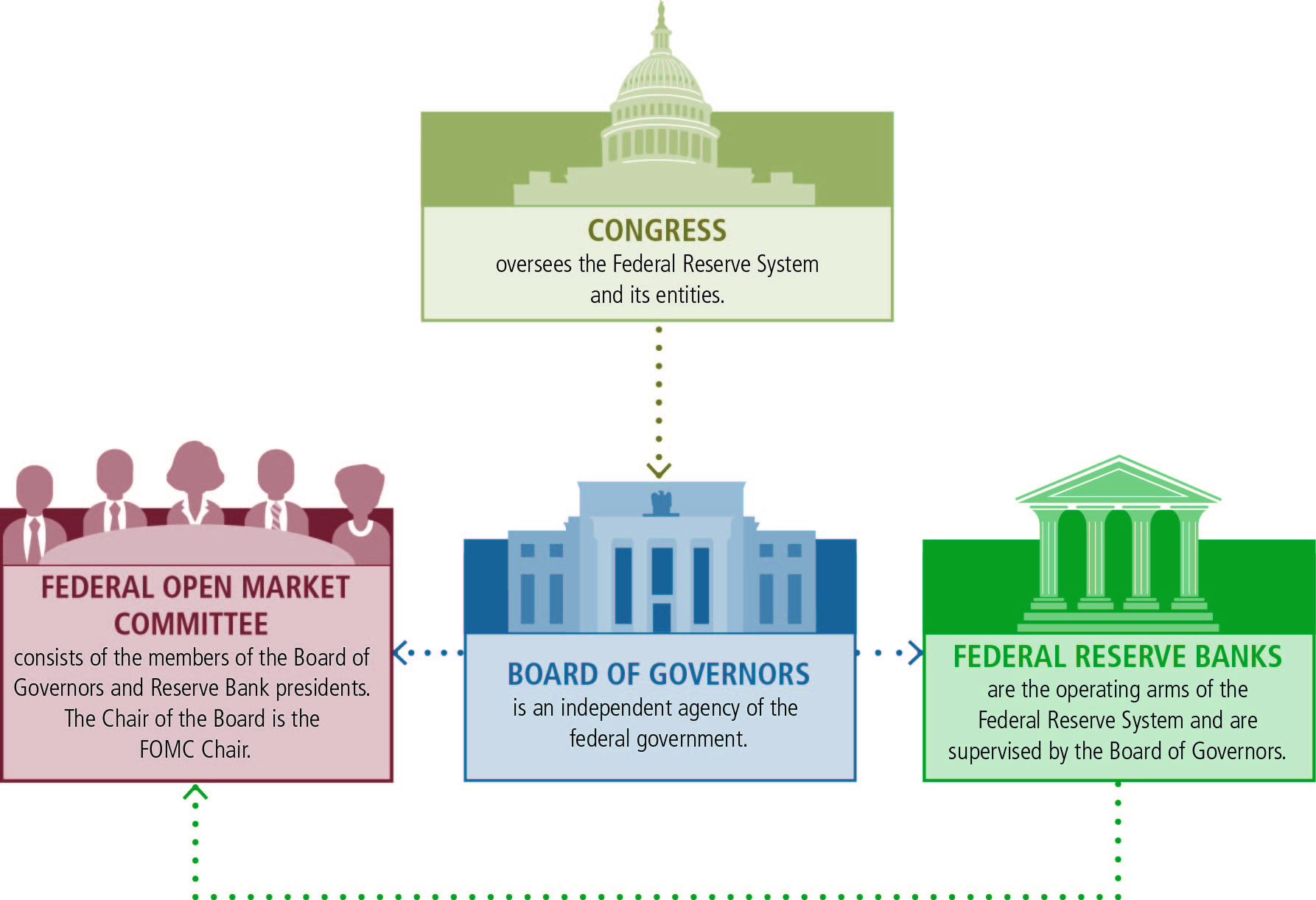

Congressional influence on the Federal Reserve System's monetary policy decisions is also in practice rather limited. The Federal Reserve generates its own revenues to pay its expenses from fees paid to it by the commercial banks it regulates and from interest payments on the federal bonds, notes and bills that it holds as assets, so Congress lacks the normal leverage it has over other agencies through carrots and sticks brandished during the annual appropriations process. Of course, Congress, which created the Federal Reserve System by statute in , has the constitutional power to alter or abolish the Federal Reserve system by a simple majority vote in both houses, subject to the possibility of a presidential veto, and the threat that Congress might actually do so if the Fed's policies contradict Congresssional preferences too seriously for too long undoubtedly induces a certain amount of responsiveness to Congressional jaw-boning by the Fed's policy-makers.

The Federal Reserve System presided over by the Board of Governors consists organizationally of 12 separate Federal Reserve District Banks -- each one located in and serving one of twelve geographical regions of the country. The district Federal Reserve banks are organized rather like private banking corporations whose shareholders consist of the private member banks in the district.

Commercial banks that are members of the Federal Reserve System In fact, the Reserve Banks are required by law to transfer net earnings to. Through these channels, monetary policy influences household spending, business investment, production, employment, and inflation in the United States.

But despite their semi-private character, the district Federal Reserve banks exercise Congressionally delegated legal powers to regulate the banking industry. Each district Federal Reserve Bank is managed from day to day by its own president, who is elected to a 5-year term by his district Federal Reserve Bank's own individual board of directors. Two-thirds of the members of the district boards of directors are elected to their positions by the privately owned commercial banks in the district that are member banks of the Federal Reserve system.

Member banks are divided on the basis of their assets into "small", "medium", and "large" banks, with each category of banks allowed to elect two directors on a "one bank, one vote" basis. The other one- third of the directors in each district are appointed from Washington by the Fed's Board of Governors, rather as though the Board of Governers were a major creditor or minority stockholder with guaranteed representation on the district boards. The district Federal Reserve Banks act as non-profit "bankers' banks" -- that is, only commercial banking or depository institutions and certain agencies of the federal government maintain deposits at the Federal Reserve, and only member banking institutions and the US government are eligible to receive loans from it, not private citizens nor other kinds of non-bank commercial enterprises.

In its role as the central bank of the United States, the Fed serves as a banker's bank and as the government's bank. Policy makers led by Chairman Ben S. These objectives are sometimes referred to as the Federal Reserve's dual mandate". For nearly eighty years, the U. Thomas July 31, It took over this role from the private sector "clearing houses" which operated during the Free Banking Era; whether public or private, the availability of liquidity was intended to prevent bank runs.

All banks chartered as "national banks" by Federal law must be "member banks," that as such are obligated to maintain most of their reserves as deposits in their accounts at the Federal Reserve and to submit to detailed Federal Reserve banking regulations. The Reserve Banks are not operated for profit, and ownership of a certain amount of stock is, by law, a condition of membership in the System. In fact, the Reserve Banks are required by law to transfer net earnings to the U. Treasury, after providing for all necessary expenses of the Reserve Banks, legally required dividend payments, and maintaining a limited balance in a surplus fund.

Federal Reserve Board issues interim final rule regarding dividend payments on Reserve Bank capital stock. The Federal Reserve System: What is the purpose of the Federal Reserve System? What does it mean that the Federal Reserve is "independent within the government"? Does the Federal Reserve ever get audited? Thus, Congress can no longer fulfill its constitutional responsibility to the public to regulate the value of our money, the vast majority of which private banks and, by the s, shadow banks create through private-interest-bearing debt.

From Wikipedia, the free encyclopedia. This section does not cite any sources.

- Federal Reserve System - Wikipedia.

- Nowhere to Hide [Pine Valley 1] (Siren Publishing Menage and More).

- Federal Reserve Act;

- Monetary Policy.

Please help improve this section by adding citations to reliable sources. Unsourced material may be challenged and removed. April Learn how and when to remove this template message. Criticism of the Federal Reserve. January 9, , letter from the Secretary of the Commission and a draft bill to incorporate the National Reserve Association of the United States, and for other purposes. Davison , a J. Piatt Andrew , former secretary of the National Monetary Commission and then assistant secretary of the Treasury.

Nelson Aldrich and the Origins of the Fed". See also book review. Archived from the original PDF on Retrieved on 11 November The Federal Reserve , p. A Monetary History of the United States, — National Bureau of Economic Research.

Journal of Economic History. Journal of Political Economy. Federal Reserve Bank of St. The Lost Science of Money. Money creation in the modern economy. Quarterly Bulletin, Bank of England. Discount window Federal funds Federal funds rate Primary dealer. Federal Reserve Flash Crash August stock markets fall —16 stock market selloff. Hamlin — William P.

Harding — Daniel R. Crissinger — Roy A. Young — Eugene Meyer — Eugene R. Black — Marriner S. Eccles — Thomas B.

Index: Political Economy Terms

McCabe — William M. Martin — Arthur F. Rosengren Boston John C. Williams New York Patrick T. Harker Philadelphia Loretta J. Mester Cleveland Jeffrey M.

Federal Reserve Act

Evans Chicago James B. Gould Acting - San Francisco.

Bank regulation in the United States. Credit union Federal savings association Federal savings bank National bank State bank. Retrieved from " https: Webarchive template wayback links All articles with unsourced statements Articles with unsourced statements from December Articles with unsourced statements from December Articles needing additional references from April All articles needing additional references Articles with unsourced statements from January Articles with unsourced statements from August Wikipedia articles with LCCN identifiers Wikipedia articles with VIAF identifiers.

Views Read Edit View history. This page was last edited on 10 August , at By using this site, you agree to the Terms of Use and Privacy Policy.

An Act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.